What Happened in 1971?

Something happened in 1971 that is directly responsible for the ascendancy of Donald Trump.

In 1971, a global monetary crisis was imminent and American elites faced two paths forward. The American economy was under intense pressure: Vietnam War spending, Johnson’s Great Society programs, and swelling trade deficits had eroded the credibility of the US economy. Foreign investors started preparing for a US heading towards bankruptcy, so foreign central banks—most notably France’s de Gaulle—were redeeming their physical gold and shipping it back home. Physical gold, real wealth, which the US had accumulated over a century, was flooding out of the country. An economic depression was imminent.

One path forward, favored by industrialists, military hardliners, Texas conservatives, Howard Buffet, John Birchers, and America First Buchananites, favored tolerating a painful but honest restructuring: devaluation of the dollar, higher interest rates, keeping US supply chains at home, and re-affirming a national commitment to energy, labor, and food sovereignty. Under this model, gold convertibility could have been preserved—at a higher price—and the dollar would have continued to function as a smaller and devalued global currency backed by the tangible output of American labor, land, and industry. These thinkers however never really had institutional dominance, but relied on powerful voices across the military and representatives of America’s core middle class. Oilmen, miners, farmers, and manufacturers.

The other path, which ultimately prevailed, was driven by a coalition of financial elites and geopolitical strategists who were already well-entrenched within elite American institutions. The Council on Foreign Relations (CFR), The Brookings Institution, economists at Harvard and MIT, the Trilateral Commission, and the IMF/World Bank Atlanticists were already coordinating to push for a world where national sovereignty would be subordinated to multilateral governance networks ruled by Wall Street and the State Department. They argued for building a new system: one based on the dollar's role as the global reserve currency, backed not by America’s raw manufacturing, labor, and commodity power, but by control of global liquidity flows. Rather than suffer a hard internal reset, they chose to float the dollar, abandon gold, keep the economy going, export American labor and supply chains abroad, and maintain global dollar hegemony through soft financial power abroad.

Harold Malmgren & Kissinger’s “PetroDollar”

In steps Harald Malmgren. One of the most influential and powerful Americans you’ve likely never heard of. Dubbed one of Americas post-war “whiz kids” he was promptly shuffled into MIT at the age of 14. The humble Swede ended up avoiding global nuclear catastrophe during The Cuban Missile Crisis by getting Curtis Lemay to stand down in a moment where fingers where on the nuclear trigger. Later, he became a trusted presidential advisor not just to JFK, but LBJ, Nixon and Ford. He was tasked with handling Americas’ most classified communications with Putin, Japan, the Vatican, and other foreign leaders, simultaneously acting as a trusted liaison to the White House, protecting the CIA’s numerous black operations and “crown jewels.” He is described by many as one of America’s great strategic minds and thinkers alongside Henry Kissinger.

The elites headed by the Council on Foreign Relations ultimately won this debate and Nixon closed the gold window. While Kissinger and George Shultz shaped the high-level architecture, Malmgren was tasked to engage European and Asian leaders during the critical post-1971 summits and smooth tensions over the collapse of Bretton Woods system and to build support —ultimately compliance — for what was coming next. Foreign leaders, particularly in Europe, were furious over the Nixon administration’s decision to suspend dollar-gold convertibility. To them, the U.S. had effectively defaulted on the Bretton Woods agreement by refusing to honor their post-WW2 obligations. In a closed door meeting in Iceland, tensions were high; Malmgren later recalled that European officials were “beyond angry”. They saw the move as an abuse of America's “exorbitant privilege.” Global finance ministers felt blindsided, humiliated, and economically cornered, with few good options. The US was heading for default and they cheated. Malmgren’s role was to absorb that anger and persuade global leaders to get them to accept the reality of the new system Kissinger was devising. The secret gold for oil trade involving the kingdom of Saudi Arabia, gulf monarchies, and the Bank of International Settlements (BIS) that would allow Wall Street and the State Department to control the world and access cheap labor abroad.

2. THE HIDDEN GOLD-FOR-OIL TRADE

In 1997, on an obscure forum, a cryptic poster using the pen name “ANOTHER” began dropping dense, elliptical messages that still stun readers today. He wrote in broken English, in a deliberately veiled tone, and claimed to be connected to European central banks, sovereign wealth actors, and had access to BIS meeting minutes. Some speculated he was a Rothschild, my own linguistic and stylometric analysis strongly suggest ANOTHER was a Gulf Arab (likely Saudi), educated in formal British or French schools, steeped in classical Arab rhetoric, and likely was an economic liaison for Gulf royal monarchies, interacting with the insider European central bankers.

Over the course of a few years, he explained how Kissinger’s system worked with breathtaking clarity. Instead of gold being the marker of global wealth, they turned to oil.

A deal was struck by Kissinger where gulf monarchies, primarily Saudi Arabia, would require the oil they sell to be purchased in U.S Dollars. Anyone who wanted to buy oil had to first go and buy U.S Dollars. Thus, as enormous amounts of U.S Dollars flowed in the Saudi Arabian Monetary Authority (SAMA). These dollars would be wired back into European and American bank accounts and re-invested into Western countries. The Saudi royal family agreed to store their precious oil wealth in Western bank accounts.

So throughout the 70’s-90’s, SAMA began wiring billions and billions worth of U.S Dollars back to the Federal Reserve Bank of New York (FRBNY), the Bank of England, and Swiss accounts, to be further deployed down the chain into U.S Treasury bonds, public equities, and private equity like Blackstone and Apollo. Over time, these accounts at FRBNY got so large that they started to cause nervousness of U.S Dollar currency exposure among the Saudis. So the Bank of International Settlements (BIS), via official liaisons and secure diplomatic and encrypted channels, told the Saudi's they could reduce their dollar exposure in a discreet way by wiring some of their excess balances to the BIS. These accounts might include Special Drawing Right-denominated liquidity pools in Basel which is an account with a blend of currency exposure, including gold. This allowed the monarchs to quietly hedge political risk and diversify discreetly, not visible to the public, as the BIS is immune from all international law. This structure enabled the system that exists today where the BIS coordinates with G10 countries on monetary strategy and oil price stabilization when markets get wild.

All of this seems relatively normal, but the bombshell ANOTHER dropped on this forum was that the Saudis started getting spooked and wanted more assurance this deal wouldn't be a trap for them — storing all their oil wealth in western bank accounts. ANOTHER claims that behind closed doors, BIS officials—acting as intermediaries for Western central banks—began offering western gold held in western vaults deeply below market prices to the Saudis. These were usually not recorded as sales, and no metal visibly moved; the gold never left Swiss or London vaults. Instead, custodial titles of physical gold owned by western countries were quietly reassigned—from Western vaults into BIS-registered accounts held by the Saudis and other monarchies. This arrangement enabled a subtle exchange: Saudi Arabia and gulf monarchies continued to price their cheap oil in dollars and funneling huge amounts of dollars back into Western banks. In return, they quietly accumulated thousands of tonnes worth of physical gold exposure prices far below market. The gold that was being drained from the West in the 1970s continued.

ANOTHER’s revelation is shocking because it reframes Kissinger’s petrodollar not merely as a dollar-oil arrangement, but as a concealed gold-for-oil exchange, with the dollar acting as a decoy. While most analysts believed Kissinger’s 1970s deal with Saudi Arabia hinged on pricing oil exclusively in dollars to uphold U.S. hegemony, ANOTHER revealed that in the background, American and European physical gold was being quietly transferred to the Gulf monarchies at below-market prices via BIS-facilitated channels. This was not part of public financial records or market flows.

AMERICA GUTTED

Once oil was secured in dollars and the Saudis were privately satisfied, American elites shifted their attention from production to credit, from manufacturing to financial derivatives, from Main Street to Wall Street. This was not a market outcome—it was a strategic elite decision, made in closed rooms, to preserve American global power at the expense of domestic self-sufficiency.

This shift set the stage for a profound transformation: the financialization of the U.S. economy. Industrial firms like General Electric, once emblematic of American manufacturing prowess, slowly morphed into shadow banks.

Multinationals responded accordingly. Starting in the mid-1970s, U.S. corporations began relocating labor-intensive manufacturing to East Asia, beginning with Japan and Korea, and later moving into Taiwan, Malaysia, and China. American apparel, furniture, and electronics companies—facing inflation and rising union wages at home—quietly set up shop abroad. By the early 1980s, General Electric, Ford, IBM, and Motorola had all launched aggressive foreign outsourcing strategies.

A 1982 internal GE planning memo warned:

"Rising domestic wage pressures and energy costs make it imperative to shift core product assembly abroad. We must reposition GE as a global platform company, not a domestic manufacturer."

Wall Street agreed. Equity analysts began rewarding firms not for capital investment at home, but for cost-cutting abroad. The logic of floating exchange rates and financial deregulation made foreign earnings even more attractive: companies like GE could be parked offshore, untaxed, and recycled into financial assets. Meanwhile, Washington doubled down: the U.S. entered NAFTA, normalized trade with China, and encouraged firms to “go global.”

The consequences for American labor were devastating. Entire regions were deindustrialized. Middle-class wages stagnated as productive jobs were exported to countries participating in the new global dollar trade. American farmers, manufacturers, loggers, oilmen, were no longer the backbone of the economy—they became consumers of imported goods financed by debt. Sovereignty, once grounded in energy independence and industrial power, was now contingent on foreign capital flows and the willingness of oil states and Asian exporters to keep recycling dollars back into Treasuries and equities.

By the late 1990s, the consequences of the post-1971 elite realignment were no longer abstract—they were visible on the ground. Entire swaths of the American working class had been displaced. Rust Belt towns like Detroit collapsed as factories shuttered and union jobs evaporated. Wages stagnated, while corporate profits surged. But rage was building.

This rage erupted publicly in November 1999 at what became known as the Battle of Seattle—a mass protest against China’s ascension into the World Trade Organization (WTO), drawing over 40,000 demonstrators, a highly unusual coalition of left-wing labor unions, environmentalists, anti-capitalist anarchists, hippies, and proto-MAGA conservative nationalists. Their unifying demand: an end to corporate-driven globalization, which they argued was destroying American jobs, gutting sovereignty, and subjecting working people around the world to the rule of unelected transnational institutions.

The Battle in Seattle is where MAGA began. It was a foreshadowing of deeper populist uprisings to come.

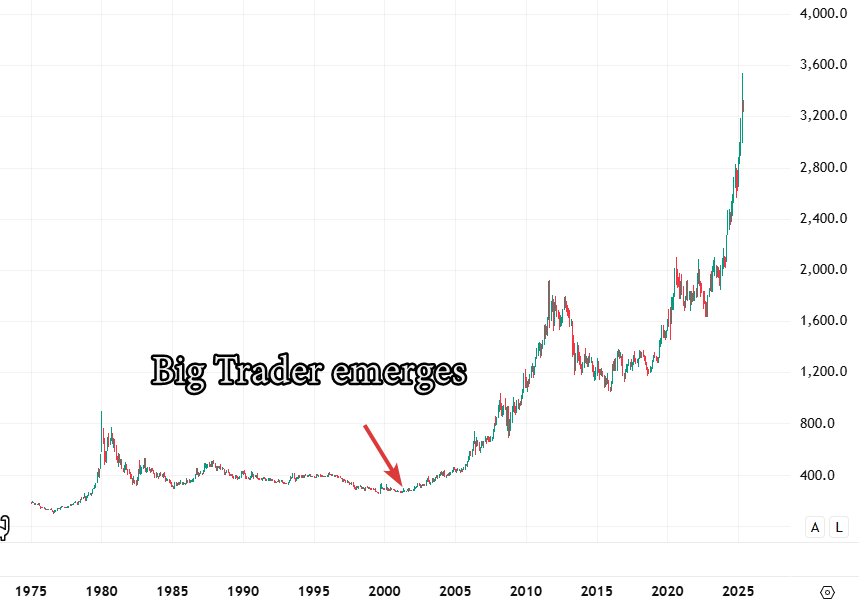

HONG KONG “BIG TRADER” EMERGES

Other than the mild domestic unhappiness outlined above, the system was humming along smoothly. Everyone was getting rich. But then, quietly, something changed.

Like Saudia Arabia in the 1970s, China was now accumulating huge amounts of U.S Dollars from the products they were selling to US consumers. Enormous wealth was flowing into the country, and at first, they played the same game of recycling some of their huge dollar surpluses back into the US as investments. But the Chinese were smarter.

In ANOTHER’s final postings on the forum in the early 2000’s, he describes a new presence emerging—one he spoke of only in passing, yet with unmistakable gravity. He called him “Big Trader.” He hints that Big Trader was working through Hong Kong, acted through Gulf intermediaries, and likely represented sovereign wealth. Sovereign Chinese wealth.

According to ANOTHER, Big Trader had knowledge: he studied Kissinger’s game and realized that gold was still flowing behind the scenes, that gold prices were being artificially suppressed, that oil producers were being compensated quietly with gold title—and he knew that gold quantities were not infinite. So Big Trader started probing the gold market. He started buying physical gold. In other words, he began to drain it. Big Trader did not buy gold on the futures exchanges like COMEX. He moved discreetly through private channels, often via bilateral, off-market agreements with bullion banks and central bank and gulf intermediaries. Gold vault outflows began in size.

The size of his footprints, even when disguised, was unmistakable: multi-ton allocations, regularly executed, taking the gold out of the system. Bullion banks began flagging the orders internally. The BIS was informed. Central bankers in Switzerland understood: someone was calling the bluff. Someone outside the system had figured out the fraudulent game. His actions were a warning: there wouldn’t be enough gold to satisfy all claims when the music stopped. Big trader marked the bottom of the gold market.

Saudi Arabia and others saw what was happening: the Western promise to settle in quiet gold was becoming harder to fulfill. Trust began to erode. Around this same time, Russia began to slowly rebuild its gold reserves, and China continued accumulated via newly opened Shanghai channels. The scramble to secure physical gold before the next financial regime change began. Everyone knew that Kissinger’s system wouldn’t last forever. So what would come next?

Great Reset or MAGA?

By the early 2010s, Western elites—particularly those embedded in the IMF, BIS, G30, and World Economic Forum— the inheritors of the Council on Foreign Relations, Trilateral Commision, and those who designed the system, had quietly accepted that their system was structurally unsustainable.

The explosion of unpayable sovereign debt, the hollowing out of productive economies, and the overextension of this carefully managed but artificial system signaled that the long cycle of financialized growth was nearing exhaustion. Rather than admit failure or attempt a hard reversion to back to honest money, they came up with a new plan. Engineer a soft landing—a slow-motion controlled collapse, wrapped in the language of sustainability, equity, and modernization. This was the true origin of what would later be branded the “Great Reset.” Not a conspiracy in the theatrical sense, but a coordinated elite effort to survive the collapse of the system they themselves had designed.

In its purest form, the Great Reset is a supra-sovereign management plan for controlled de-globalization, overseen not by nation-states, but by central banks, multilateral institutions, and unelected technocratic nodes.

This entire framework—the Great Reset, the Central Bank Digital Currency rollout, and the managed collapse of fiat—is best understood not as a monetary innovation, but as a reversion to wartime rationing. What was being planned was a slow walk into a digitally enforced version of the 1940s war economy.

Instead of food coupons, the new system would use “carbon credits,” “health incentives,” “social equity scores.” Instead of fuel rations, it will be “green credits,” “grid savings,” or “biofuel mandates.” The language changes. The mechanics do not. The goal is to hide inflation during the transition via rationing.

You may have $2,000 in your account—but only $150 is usable for meat. Only $50 can be spent more than 10 miles from home. The rest is locked, expired, or spendable only on approved goods. The average citizen doesn’t see the inflation.

The real brilliance of the system is this: it allows real commodity prices to re-anchor to gold or true scarcity, while the public never sees it in nominal terms. Energy, food, rent, and metals all rise quietly in real value—but the visible system remains frozen.

Trump

Enter Trump. Trump’s rise, beginning in 2016, can be seen as the strategic reemergence of that buried faction who lost the debate in 1971, and later the disgruntled protestors in Seattle. They’re back, with a vengeance. This time from the right and with far greater mass political force. His instincts—on tariffs, reindustrialization, energy and farmer dominance, and distrust of supranational institutions—align closely with those John Birchers (his Dad was a member), pre-WW2 America First, Buchananites, Howard Buffet, Texas oilmen, and military cold warriors.

The MAGA-Trump alternative to the Great Reset is not a reform of the existing system, but a deliberate rupture —a hard reset on American terms. Rather than manage a decline and war rationing through CBDCs, digital rationing, and ESG compliance, Trump’s circle favors a violent repricing of tangible hard assets, a return to domestic energy and food sovereignty, and the collapse of the financialization game that hollowed out America’s industrial core nearly 50 years ago. Trumps internal logic is accept short-term pain: accept 12–48 months of wild inflation, extreme economic turbulence, commodity and good shortages, and civil unrest to achieve long-term gain: re-anchor the U.S. economy around real assets — wheat, oil, steel, gold, land — not Wall Street paper.

“We are going to have to have some kind of a grand global economic reordering,” Scott Bessent said at a June event. “I’d like to be a part of it. I’ve studied this.”

Project GLASSHEART (self-inflicted economic rupture)

How does this system end? By gleaning information from intelligence and military tabletop exercises and whitepapers by the military, a coherent strategy emerges.

In 2020, The Carnegie Endowment for International Peace released a little-read report warning of a looming cyberattack on the global financial system. The authors included representatives from the Federal Reserve, the IMF, the ECB, JPMorgan, Bank of America, SWIFT, Amazon, and a long list of global tech and financial infrastructure firms. Months before, they had conducted a war-game simulation—Cyber Polygon—modeling an event in which a cyberattack took down the entire financial grid and prompted a coordinated global response.

A cyberattack—whether real, false flag, or some ambiguous blend of the two—would serve the same purpose that COVID served for the public health and biometric identity rollout: a trigger event to collapse the existing broken economic architecture created in 1971 and replace it. Quickly.

Whether externally blamed or internally initiated—it would likely begin with a disruption to payment rails or ledger systems. A Breach of a Tier-1 U.S. banking entity (e.g., JPMorgan, Mastercard, Visa), or public-facing disruption of ACH or SWIFT routing, combined with simultaneous rogue “leak” of manipulated balances, fabricated ledger mismatches, or credit score corruption. Bank balances could disappear or be misreported. ATMs and bank apps would freeze. No money is technically lost—but confidence is. Then comes the communication vacuum. The public is told the system is under attack. Rumors swirl on social media. Markets collapse. Circuit breakers are hit. It’s Iran. It’s China. It’s Russia. A rogue autonomous AI system. They shut down the markets. No trading for a few days until they figure out what’s going on. People rush to Costco to buy gold. Behind the scenes, a pre-authorized emergency protocol activates, involving the Treasury, the Fed, the intelligence community, and social media platforms.

A cyberattack of this kind—if managed by factions inside the U.S. national security state and financial apparatus and self-imposed—would serve multiple strategic objectives. First, it would distract from 50 years of central bank mismanagement and debt saturation, providing a politically clean justification for a full systemic reset. Second, it would allow the rapid introduction of new monetary infrastructures that have been developed—including FedCoin, stablecoins, digital wallets, programmable stimulus, and rationed spending tools. Third, and most crucially, it would allow the U.S. to sever its strategic vulnerabilities with China without firing a shot.

For 40 years, China has structured its growth model around: Exporting to the U.S., Recycling the surplus into U.S. Treasuries and stocks, accessing U.S. dollar systems (SWIFT, Fedwire, offshore eurodollar banks) to buy commodities, and anchoring trade relationships in the perception that the U.S. financial system is a permanent fixture. China is therefore not just a trade partner. It is a trapped stakeholder in the illusion of U.S. financial invincibility.

If that illusion is ruptured — especially if Washington controls the crisis narrative — China doesn’t have a counter-move. It can’t pull out. It can’t pivot to Europe or BRICS fast enough. It can’t dump Treasuries without destroying its own balance sheet or the their ability to sell is locked. It is forced to ride out the chaos — but without control.

In game-theoretic terms, this is self-harm with strategic asymmetry. In a controlled U.S. collapse, China cannot stabilize global demand quickly enough, cannot trigger internal consumption fast enough, and cannot convince neutral global actors of the safety of the yuan quickly enough as investors are panic buying Dollars, Euros, Swiss Francs, and gold.

The reaction inside China would likely be worse than in the U.S. Factories go quiet, export orders dry up, unemployment spikes, and riots the likes of which China has never seen. Something which may already be starting.

The Great Reset camp (WEF, IMF, BIS, Fed, ECB) wants to slow manage the collapse, cushion the elites, and use programmable CBDCs and ESG-linked compliance systems to impose a slow “soft landing” under global war rationing.

The MAGA camp is willing to accept short-term chaos, massive dollar devaluation, and even a recession or depression — so their logic is simple: break it themselves and control the global population through psychological warfare before the system breaks on their enemies’ terms.

“We have the capability of hacking into our own banking system and compromising data. We can perform a targeted, one-day attack on our own American credit card companies just now, from this room. And we can do it because, although it would be hurting to us, it would be even more hurting to them because, as prime owners of American debt, they are deeply invested in the U.S. economy. Therefore, yes, Chinese sabotaging it would make no sense. But it would make total sense if we did it ourselves. Please, meditate on my words before uttering any bullshit."

If collapse is inevitable, the actor that controls the timing, narrative, and pain distribution maintains post-collapse legitimacy.

8. Regaining National Sovereignty

The goal isn’t to return to the old system, but to replace it with one grounded in real productive capacity, not debt and illusion. In this model, the United States begins a painful but deliberate process of rebuilding around its strategic physical assets: domestic oil and gas, grain, steel, timber, water, and land. Industrial policy returns to the center of governance. Trump’s voter base gain real economic power again. Critical manufacturing—energy infrastructure, food production and processing, rare earths, defense, and semiconductors—is brought home, either through mandate or sheer market revaluation.

The dollar and dollar backed stablecoins, in this reset, may be devalued or restructured, but it is re-anchored: not to gold necessarily, but to the implicit weight of American energy, agriculture, and territorial security. Regional trade agreements are rewritten around bilateral trust and resource exchange—not financial abstractions. Wall Street’s influence collapses; the new arbitrage is between physical production and strategic resilience. This is not a restoration of the past. It is a new industrial settlement built on what America still controls: its landmass, labor force, and natural endowments. In this model, sovereignty isn’t declared—it is materially backed.

Very good article !